India, the preferred destination for global sourcing

n the ever-shifting world of global sourcing, the past five years have been nothing short of a rollercoaster. From trade wars to the far-reaching effects of the COVID-19 pandemic, natural disasters, supply bottlenecks, Brexit, and geopolitical conflicts like the Ukraine-Russia war and the Israel-Hamas conflict, businesses worldwide have faced an unprecedented series of challenges, the effects of which continue to linger. The seismic shift triggered primarily by the pandemic has compelled businesses to reevaluate their sourcing paradigms.

One discernible trend is the newfound emphasis on diversifying supply chains, as businesses grapple with the risks associated with over-reliance on a single source. The result has been a surge in nearshoring and reshoring initiatives, a strategic maneuver to reduce vulnerabilities and enhance operational flexibility. Simultaneously, an increased awareness of the social and environmental impacts of supply chains has catalyzed a demand for sustainable and ethical sourcing practices. The lessons learned during the pandemic point to a need for revolutionizing global sourcing.

India takes centerstage in the new global sourcing revolution

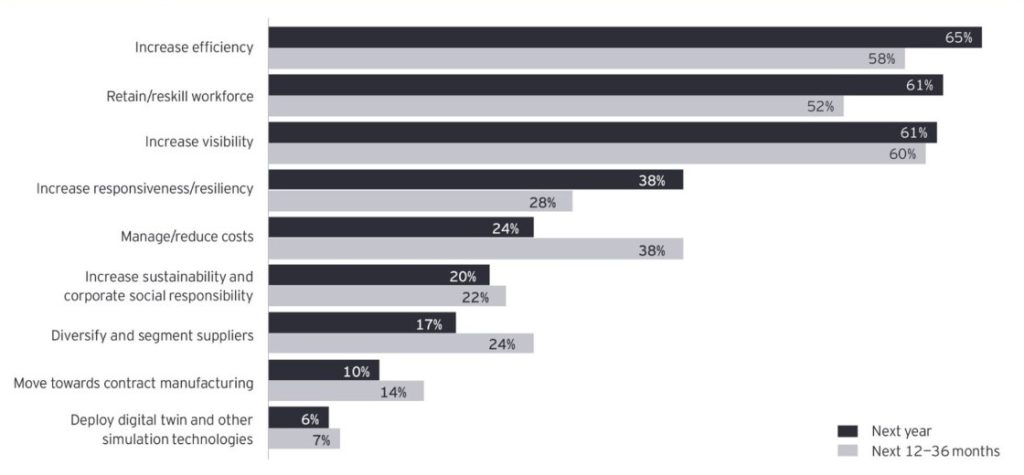

Risk management strategies have taken center-stage, emphasizing the crucial task of identifying and mitigating potential disruptions. As businesses navigate these complexities, agility and flexibility have become paramount in the evolving narrative of global sourcing. Transparency and efficiency are no longer just buzzwords; they’re now a top priority for 60% plus business, as per a white paper published by Reuters Events in partnership with Maersk in January 2023. The lessons learned during this period of disruption are shaping a new era of sourcing practices, triggering a heightened demand and interest in sourcing from India as a ‘China plus one’ option. The slow recalibration of American and European countries, reducing their reliance on China, underscores a broader trend.

As a technology-enabled global sourcing platform based in India, Qalara stands at the intersection of varied perspectives. We are in constant dialogue with stakeholders spanning across small and large-scale wholesalers, retailers, boutique owners, hoteliers, sourcing agents from around the world who have been sourcing from India or express a strong interest in doing so. Regardless, a recurring theme echoes through these conversations – the quest for reliable and ethical vendors and manufacturers capable of consistently delivering high-quality products meeting international standards, without taking shortcuts.

Many businesses have found their happy place in India, regularly increasing the volume of manufacturing and sourcing from here. Here are a few examples across industries:

⬝ IKEA: In a bid to keep its prices down, IKEA currently sources 30% of its products locally from India, but hopes to increase that number to over 50% in the years to come. Highlighting India’s tremendous potential, Deputy CEO and CFO Juvencio Maeztu maintains that

India has a fantastic opportunity to be a manufacturing hub for the entire world

with the value of Ikea’s sourcing from India estimated to be more than INR 5,000 crore (over USD 1 billion).

⬝ UNIQLO: Japanese retailer Uniqlo is set to ramp up its presence in the Indian market. The company has expressed its intention to enhance the number of stores in the country, aiming for a significant expansion to tap into the growing consumer base. This move aligns with UNIQLO’s strategic vision to strengthen its foothold in the Indian retail landscape, catering to the increasing demand for its products. The brand is already sourcing more than 30% from India for its Indian and global stores. With the opening of two new stores in Mumbai, it is gearing up to take that number significantly higher.

INDIA HAS EMERGED AS ONE OF THE WINNERS IN GLOBAL MANUFACTURING OVER THE PAST FIVE YEARS, WITH ITS EXPORTS TO THE US SURGING BY $23 BILLION, A 44% INCREASE FROM 2018 TO 2022

– BOSTON CONSULTING GROUP

⬝ ZARA, GAP, Levi’s, Mango, Marks & Spencer, Tommy Hilfiger and more: Large Fashion retailers including Zara, Gap, Levi’s, Mango, Marks & Spencer, Tommy Hilfiger, to name a few, also have a manufacturing presence in India. Geopolitical concerns and rising labor abuse issues in certain Southeast Asian countries have turned the spotlight on India. Rahul Mehta, president of the Clothing Manufacturers Association of India, notes a growing interest from global players in boosting local sourcing and manufacturing from India. He recently told Financial Express,

Global majors are looking to increase their local sourcing and manufacturing needs from India than they did earlier. One reason for this is the increasing unease and wariness they feel in some South East Asian countries owing to the geopolitical situation there and growing labor abuse issues.

H&M and ZARA have phased-out sourcing from Myanmar amid reports of widespread worker abuse, unpaid wages, forced salary reductions, as well as union intimidation.

India exports about $16 billion worth of apparel, while its domestic market is estimated at $80-100 billion. Both foreign and Indian brands are expanding manufacturing in India to maintain competitive price points. The Economic Survey has predicted a 7.5% growth in the manufacturing sector in FY2023 (projected) vs. 4.1% in FY2022.

⬝ Crocs, Nike, adidas: Tamil Nadu is strategically positioning itself in the global market for non-leather footwear, with the establishment of a footwear park in Perambalur, inaugurated in November 2023. The Crocs factory, a joint venture between Taiwan’s Shoetown and India’s Phoenix-Kothari Group, signals a significant shift toward diversifying production and supply chains with a China+1 strategy.

Other Taiwanese giants, like Feng Tay, Pou Chen, and Hong Fu, are also setting up non-leather shoe factories in Tamil Nadu, drawn by the state’s 2022 footwear and leather products policy offering subsidies and support for foreign investment. And it’s not just Crocs! Nike, Adidas, and Puma will also be manufactured in Tamil Nadu by Taiwanese giants.

⬝ Walmart: Walmart views India as crucial in its strategy to expand manufacturing capacity, with a focus on importing $10 billion worth of goods annually by 2027. Andrea Albright, Walmart’s executive vice president of sourcing told Reuters that Walmart is importing goods ranging from toys and electronics to bicycles and pharmaceuticals from India to the US. Packaged food, dry grains and pasta are also popular imports from India, she added. India-made apparel, homeware, jewelry, and other popular products reach customers in 14 markets, including the US, Canada, Mexico, Central America, and the United Kingdom via Walmart’s Global Sourcing office in Bengaluru, which opened in 2002.

Walmart, which acquired a 77% stake in Flipkart in 2018, is currently importing around $3 billion worth of products from India each year. Walmart’s interest in India is driven by the country’s growing workforce, technological advancements, and its potential to excel in low-cost, large-scale manufacturing. The company, operating in India since 2002, employs over 100,000 people across various units.

⬝ Apple: Tech giant Apple is the latest company to hop onto the India bandwagon. The California-based company has assembled low-end iPhone models in India since 2017 and began making its iPhone 14 in India within weeks of its launch last year.

J.P. Morgan predicts that a significant chunk, approximately a quarter, of all Apple iPhones will be produced in India by 2025. Foxconn, Apple’s key manufacturing partner, is gearing up to expand iPhone production at its current facility near Chennai, Tamil Nadu. The goal is ambitious: to increase annual iPhone production to around 20 million units by 2024, accompanied by a threefold rise in the workforce, potentially reaching up to 100,000 employees, according to insider sources as reported by The Wall Street Journal.

While Apple currently manufactures 5% to 7% of its iPhones in India, a notable surge from the 1% in 2021, the momentum is far from slowing down. The company has ambitious plans in motion, aiming to solidify its presence and influence in the Indian market.

The list doesn’t end here. Other companies that have started production in India or are in the process of sealing the deal include Boeing, Nokia, Ericsson, Samsung, and LG. India has gone from making 9% of the world’s smartphone handsets in 2016 to a projected 19% in 2023, according to Counterpoint Technology Market Research. Four makers account for over 80% of India’s expanding telecom exports. These include Samsung (35%), Wistron (17%), Hon Hai Precision Industry (17%), Pagatron (12%).

What makes India so attractive?

In the face of global challenges and disruptions in 2022, India’s manufacturing sector has shown robust and consistent growth throughout the year. The country has ascended to become the world’s second most coveted manufacturing hub, owing to its enhanced operational environment, cost-effectiveness, low labor costs, abundant talent pool, and success in fulfilling outsourcing needs. These factors collectively position India as a leading contender on the global stage, moving closer to China in establishing itself as the preferred global manufacturing hub. This is indicative of India’s resilience and attractiveness in the manufacturing landscape.

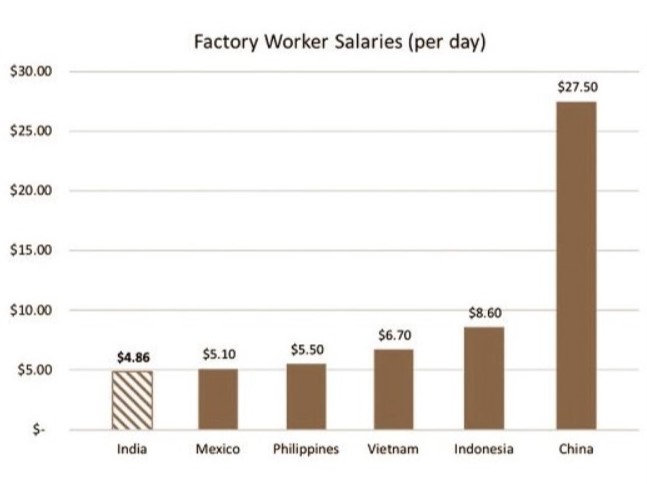

⬝ Cost advantage: As per BCG’s calculations, the average landed cost of Indian-made goods is 11.5% lower than goods made in China. This includes factory wages adjusted for productivity, logistics, tariffs and energy.

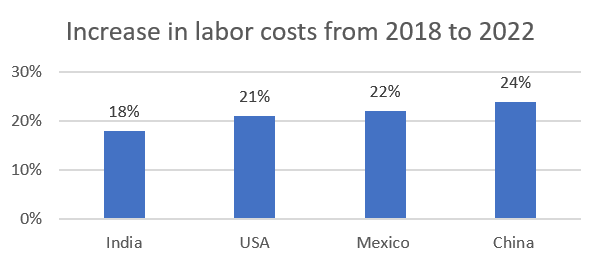

In the period from 2018 to 2022, wage inflation has exceeded productivity gains in various regions globally. However, India stands out as a winner. The study by BCG reveals that labor costs adjusted for productivity increased by 18% in India during this period, compared to higher increases in the US (21%), China (24%), and Mexico (22%). Despite these increases, India, along with Mexico, remains among the most cost-competitive sources for manufacturing, with Mexico being particularly competitive as a near-shore option for the USA.

⬝ A young workforce: India’s young labor force stands out for its demographic dividend, characterized by a large, youthful population (with a median age of 28) that is increasingly becoming educated, skilled, and entrepreneurial. India’s young workforce is also known for its adaptability to new technologies and innovative solutions in various industries, including supply chain management as per the World Economic Forum – The Future of Jobs Report. The median age of 28 signifies a workforce that is likely to possess contemporary skills, making them well-suited for roles in the evolving landscape of supply chain and logistics.

⬝ A growing economy: In the last 5 years, India has grown to become the 5th largest economy in the world, and with it has come massive infrastructure and tremendous digitization. According to the IMF forecast, India is anticipated to become the third-largest economy by 2027. This trajectory highlights India’s potential as a significant economic force in the coming years. India has come out of the pandemic reasonably well, with GDP growth of 7.2% in fiscal year 2023 (ended March 2023). Expansion may cool to 6% in fiscal 2024 due to a global slowdown and the lagged effect of policy rate hikes by the Reserve Bank of India, according to S&P Global, but even at this rate, India will be the fastest-growing economy in the G20.

⬝ A wealth of raw materials: As the largest global producer of cotton, India is a major player in the textile sector, while its substantial contributions to the jute, wood, gemstone jewelry, and marble and stone industries further enhance its export capabilities. The country’s agro-climatic diversity supports the cultivation of spices and other natural materials like hemp, cork, grasses, banana, coconut, bolstering the production of organic products that are growing in popularity.

Additionally, India’s mineral wealth plays a crucial role in metal and alloy exports. With a rich array of raw materials and a diverse geography, India stands as a strategic and versatile source for global exports, catering to a wide range of industries.

⬝ Artisanal meets mechanized: The synergy between traditional craftsmanship and technological advancements positions India as a unique player in the global manufacturing landscape, giving it a competitive edge that many other countries lack. Specializing in artisanal techniques like handweaving, inlay, wood carving, metal crafts, inlay, marquetry, embroidery, hand block printing, pottery and many others, India is able to tap into the global handicrafts market that is projected to reach US$550 billion by 2025.

India has 7 million artisans working in over 114 identified craft clusters as per the Ministry of Textiles, 2023, who contribute substantially to this thriving sector. Some of the biggest fashion houses and designers have worked with local Indian artisans creating iconic collections and styles that continue to be a talking point in the fashion world. Hermès, Chanel’s Métiers d’Art Collection and the recent Dior fall 2023 range are a case in point.

⬝ Attractive incentives: The Indian government has introduced a range of incentives to promote manufacturing and boost exports. Under the Production-Linked Incentive (PLI) scheme, various sectors receive financial incentives to enhance their production capabilities. This initiative aims to attract investment, create job opportunities, and propel India’s manufacturing prowess on the global stage. These sector-specific schemes are yielding positive results. For instance, the mobile phone PLI scheme attracted investments of over ₹40,000 crore (US$48 billion) in 2022-23, boosting domestic production.

Additionally, the Export Credit Guarantee Corporation (ECGC) offers credit insurance and financial support to exporters, safeguarding them against risks and uncertainties associated with international trade. With schemes like Merchandise Exports from India Scheme (MEIS) and Service Exports from India Scheme (SEIS), the government provides financial benefits and incentives to exporters, encouraging them to explore new markets and expand their global footprint. These initiatives collectively contribute to the growth of India’s manufacturing sector and bolster the nation’s position in the global export landscape.

⬝ The geographic and cultural advantage: India, with its rich history spanning millennia, has played a pivotal role in shaping global trade and commerce. Beyond being a hub of spices and silks, gemstones and cotton, India’s design aesthetics have inspired leading brands for centuries. India’s historical significance in trade and commerce and timeless designs continue to resonate in the modern world.

Conclusion

Our ‘Next stop, India: The top choice for global sourcing beyond China’ publication, slated to release in the last quarter of 2024, unravels India’s unique potential to become a leader and strong ‘China plus one’ contender in global sourcing. Backed by data and insights, this first-of-its-kind publication from India analyses and forecasts global trends in retail and sourcing, bringing you a low-down on the evolving landscape of international trade. From the changing dynamics of supply chains to the emergence of India as a pivotal player, this upcoming publication dives deep into the intricacies of global commerce.

This teaser publication explores India’s rising prominence as a global sourcing favorite. If you would like us to send you a free copy, drop us a line with your email id in the comments section below or shoot us a mail at buyers@qalara.com.

~ Written by Sheena Thomas

Strata Painters Sydney

This text is invaluable. How can I find out more?