How Wholesale Buyers Stand to Gain from India’s FTA Roadmap

s India speeds up its Free Trade Agreement (FTA) negotiations and implementations with the EU, EFTA, Australia, New Zealand & others, wholesale buyers globally (and in partner countries) have a unique window of opportunity. Lower tariffs, clearer regulations, better sourcing, and competitive cost structures are all part of the promise. This blog examines what wholesalers should expect, what can change, and how to prepare to maximize gains.

Qalara is perfectly placed to help international buyers tap into this opportunity. As a global B2B sourcing platform for artisanal, eco-friendly, and ethically produced Indian goods, Qalara already vets suppliers for quality, sustainability, and export readiness. With India’s FTAs lowering trade barriers and simplifying customs, Qalara’s curated network and end-to-end logistics make it easier than ever for importers to discover new product lines, negotiate competitive prices, and scale orders with confidence.

• Why Now? India’s Multi-Lane FTA Strategy

As India engages FTAs with the EU, EFTA, Australia, New Zealand, and others, foreign buyers are in a strong position to gain. These agreements are changing the cost structure, regulatory environment, and reliability of sourcing from India. Below are partner-by-partner snapshots of what’s shifting, and why you as a buyer should pay attention.

- European Union (EU)

Negotiations between India and the EU have reached a crucial stage, with over 60% of chapters finalized. Both sides are now pushing to wrap up the deal by the end of 2025. This means buyers can expect significantly reduced import duties on Indian industrial goods, clearer rules on digital trade/services, stronger protections/standards, and fewer non-tariff obstacles. If you currently import apparel, pharmaceuticals, steel, chemicals or auto parts from India (or plan to), the EU-India FTA will likely lower your costs, improve predictability, and allow better planning. But note: areas like agriculture, dairy, and strict EU standards will still have barriers or phased implementation.

- EFTA (Switzerland, Norway, Iceland, Liechtenstein)

The India-EFTA Trade & Economic Partnership (TEPA) is expected to come into effect from October 1, 2025. For foreign buyers in EFTA countries or elsewhere sourcing Indian goods for export or resale, this opens up duty reductions or duty-free access to many Indian industrial and processed goods. The deal also includes broad tariff concessions on many goods, and a commitment of USD 100 billion investment over 15 years from EFTA into India, which suggests Indian suppliers will have stronger capacities, better infrastructure, and more reliability. Buyers can leverage this to source items like machinery, chemicals, processed foods, engineering components and more, at more competitive landed costs, once origin rules are satisfied.

- Australia

While the full Comprehensive Economic Cooperation Agreement (CECA) is in progress, the existing India-Australia ECTA (Economic Cooperation & Trade Agreement) already provides preferential tariff access for many goods. For buyers in Australia (or those who distribute into that market), this means better margin possibilities when sourcing from India: Indian gems & jewellery, textiles, processed goods, components — especially those suffering previously under high import duties — will become more price-competitive. Also, given Australia’s demand for imported inputs (agricultural supplies, minerals) and India’s growing manufacturing capacity, the supply chain options will improve.

- New Zealand

Although concrete details are still being negotiated with New Zealand, resuming FTA talks signals that more favourable conditions are likely ahead. For New Zealand buyers, this means that over the next few years, you should expect smoother customs, reduced tariffs on certain Indian goods, simpler compliance, and possibly better services trade terms. For example, niche or seasonal imports (foods, specialty agricultural products, or Indian artisanal goods) will benefit. If your sourcing depends on Indian suppliers of such goods, you should get ahead in vetting suppliers for quality, logistics, and compliance.

- Other Markets (US, Global Importers)

India’s broader strategy (US, UK, and other partners) means that many buyers outside these blocs want to position themselves to be first movers. As India signs or ratifies more FTAs and incorporates strong clauses on services, origin, sustainability, digital trade, etc., buyers who already have relationships with Indian suppliers can negotiate better deals ahead of the curve. Even if your market isn’t immediately part of these FTAs, sourcing from Indian firms that serve other FTA markets can mean better overall standards, lower production costs, and improved reliability. Also, as Indian exporters gear up for multiple FTAs, competition among them will likely push down prices and improve quality to win in these diverse markets.

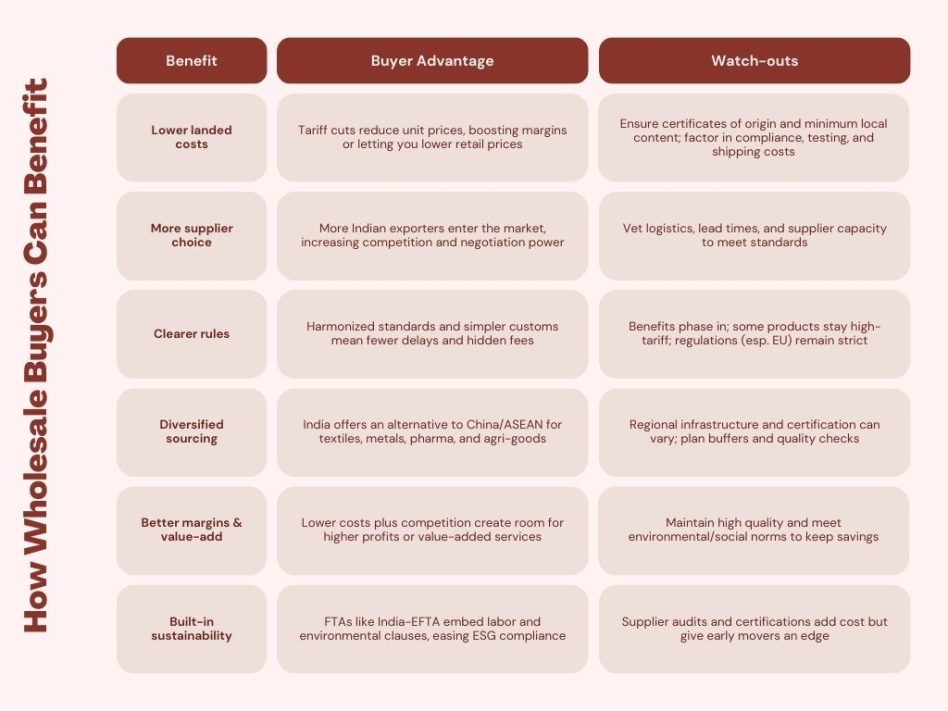

• How Wholesale Buyers Can Benefit

Wholesale buyers include importers, distributors, bulk retail chains, and those sourcing for resale. Here are the benefits, with caveats, to expect under the FTA roadmap.

• Key Implications & What Buyers Should Do

- Map your current imports from India: check HS codes of your top-imported items; evaluate which ones are likely to enjoy tariff reductions under the upcoming FTAs.

- Ask suppliers about their FTA readiness: Are they certified for origin rules? Do they comply with international standards (SPS, labour, environmental)? Can they meet documentation/labelling/packaging norms for your market?

- Negotiate now, lock in favorable contracts: When FTAs phase in tariff drops, buyers with existing contracts or volume commitments may benefit more. Early negotiation gives you better leverage.

- Monitor implementation timelines: Many FTA benefits won’t be immediate. Tariff cuts often phase out over years. Know when thresholds or drop points happen.

- Think quality, reliability, supply-chain risk: Lower tariffs won’t help if delays, poor quality, or non-compliance lead to additional costs. Vet suppliers, understand logistics and customs processes.

- Plan for competition: Other importers will use the same advantages. Being ready early gives you head start in offering better prices and variety.

• Why Qalara is the Smart Choice for FTA-Ready Sourcing

For wholesale buyers planning to take advantage of India’s FTA roadmap, choosing the right sourcing partner can make all the difference. This is where Qalara stands out:

- FTA-ready suppliers: Qalara curates exporters who already comply with international trade standards, including certifications, packaging norms, and sustainability requirements, making them well-positioned to benefit from tariff reductions.

- Lower landed costs with ease: Instead of struggling with origin rules and documentation, Qalara streamlines compliance, customs, and logistics, ensuring you actually realize the savings promised under FTAs.

- Diverse Indian product categories: From artisanal, eco-friendly, and ethically produced goods to industrial categories, Qalara connects buyers with Indian suppliers across multiple verticals—helping diversify sourcing while keeping quality intact.

- Built-in logistics & transparency: With end-to-end support, buyers don’t just get access to Indian suppliers—they also get reliable fulfillment, transparent pricing, and scalable order management.

- Sustainability advantage: As FTAs (like India-EFTA) increasingly embed environmental and labour clauses, Qalara’s pre-vetted network gives buyers a head start on ESG compliance.

In short, Qalara allows wholesale buyers to leverage the benefits of India’s FTA roadmap without the typical sourcing risks, unlocking competitive pricing, diverse product lines, and smoother import processes.

Also read: How Qalara has made life easier for buyers

• A Turning Point For Global Sourcing

India’s accelerating free trade agenda signals a turning point for global sourcing. For overseas wholesalers, the benefits are tangible: lower tariffs, a larger pool of competitive suppliers, and improved regulatory clarity that cuts down on surprise costs. Yet the rewards will flow first to those who prepare—mapping HS codes, locking in contracts early, and ensuring suppliers can meet origin and compliance standards. With implementation timelines stretching over months and years, early movers can secure pricing advantages and priority access while others scramble to catch up.

Ready to leverage India’s FTA roadmap? Explore products on Qalara today →

~ Written by Kartik Singh Khati

Also read: The causes & dangers of over-production

Leave a Reply