What the UK–India FTA Means for UK Businesses

n 6 May 2025, the UK and India announced a landmark free trade agreement (FTA), described by UK officials as the most significant bilateral deal since Brexit. Following three years of negotiations, Prime Ministers Starmer and Modi reached a deal designed to boost trade and investment between two complementary economies. As India is set to become the world’s third-largest economy by 2028, the FTA gives UK businesses—especially SMEs—unprecedented access to this fast-growing market. Part of the UK’s “Plan for Change,” the agreement reduces barriers across goods, services, digital trade, and government procurement. India gains better access to the UK market for textiles and IT services, while British exports like whisky, cars, and pharmaceuticals benefit from reduced tariffs and streamlined trade procedures.

Amid these new opportunities, Qalara offers UK businesses a trusted gateway to source directly from verified Indian manufacturers. With streamlined logistics, low MOQs, and ethical sourcing, Qalara simplifies importing under the FTA’s favourable terms.

Economic Impact

The economic case for the FTA is substantial. Even before the deal, UK–India trade was already growing: in 2024 bilateral trade in goods and services reached about £42.6 billion. Official modelling suggests that removing barriers could roughly double UK-India trade by 2030. In the long run the boost to UK GDP is expected to be several billion pounds. The new agreement is expected to increase bilateral trade between the countries by $34 billion a year from 2040.

Tariff Reductions: A Win for UK Exporters

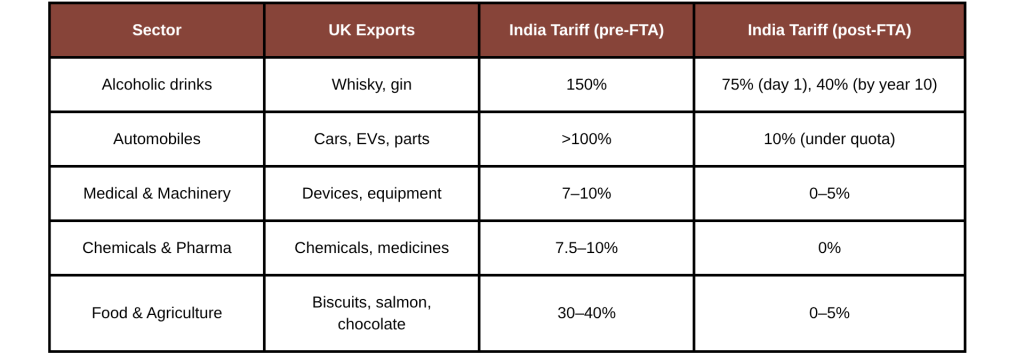

The FTA features major tariff cuts, giving UK exporters improved market access:

1. Alcoholic Drinks: India’s current 150% tariff on Scotch whisky and gin will drop to 75% immediately, and to 40% within 10 years. This opens new opportunities in the world’s largest whisky market.

2. Automobiles: Tariffs on cars and EVs (currently over 100%) will be capped at 10% under a quota system—benefiting high-end UK manufacturers like Jaguar Land Rover and Lotus.

3. Medical Devices & Machinery: Tariffs of 7–10% on UK-made diagnostic equipment and advanced machinery will fall to 0–5%.

4. Chemicals & Pharmaceuticals: Import duties (7.5–10%) on chemicals and drugs will be cut to 0%.

5. Food & Beverages: Luxury and processed foods such as chocolate, biscuits, and seafood (formerly taxed at 30–40%) will see tariffs reduced to as low as 0–5%.

This liberalisation means that thousands of UK products will be cheaper and more competitive in India from day one.

Key Tariff Cuts at a Glance

Non-Tariff Benefits: Making Trade Easier

Beyond tariffs, the FTA offers structural improvements to trade:

1. Government Procurement: UK firms will access India’s £38 billion annual public procurement market. British companies can now bid for infrastructure and technology projects on equal footing with domestic competitors.

2. Customs & Facilitation: The FTA mandates faster customs clearance (within 48 hours for most goods), paperless trade, and English-language transparency. Technical standards and SPS measures will be harmonized, easing trade friction.

3. Digital & IP Protections: Rules on cross-border data flows, source code protection, and extended copyright terms (to 60 years) give UK tech firms and creators more confidence in Indian markets.

4. Regulatory Alignment: New channels for cooperation on environmental, labour, and anti-corruption standards improve trust and predictability. Notably, India has agreed to anti-corruption clauses for the first time in an FTA.

These reforms are particularly helpful for UK SMEs, which often struggle with red tape in foreign markets.

Opportunities for UK Industries

The agreement unlocks growth potential across several UK sectors:

- Luxury Goods & Beverages: Lower tariffs make UK spirits and premium products more accessible to India’s rising middle class.

- Automotive: EVs and luxury vehicles will benefit from reduced tariffs and India’s expanding demand.

- Life Sciences: UK pharmaceutical and medical-tech exporters gain duty-free access to a huge healthcare market, with streamlined standards.

- Food & Drink: British specialties like lamb, salmon, and confectionery become more affordable in India. UK imports of Indian products (rice, spices, seafood) also become cheaper, benefiting UK consumers and retailers.

- Digital & Creative Industries: Digital trade provisions ensure legal recognition of e-contracts, data flow protections, and IP enforcement—vital for UK tech, media, and edtech firms.

- Financial Services: UK banks, insurers and fintechs get equal access to India’s market. Investment caps are locked in, and cooperation on cross-border payments and fintech regulation is encouraged.

- Professional Services: A dedicated annex ensures easier recognition of qualifications and streamlined visa procedures for consultants, architects, accountants, and engineers.

- Advanced Manufacturing: Tariff cuts on industrial goods (machinery, electronics, chemicals) create new supply chain opportunities and joint venture possibilities.

- Luxury Goods & Beverages: Lower tariffs make UK spirits and premium products more accessible to India’s rising middle class.

In total, 64% of UK exports to India (worth £1.9 billion) will become duty-free immediately, rising to 85% over time.

Conclusion

The UK–India FTA is expected to boost UK exports by up to 59% by 2040, drive billions in additional trade, and create thousands of jobs. It also marks a shift toward a more equal and forward-looking UK–India partnership.

For UK businesses—especially SMEs—the opportunity is clear: with fewer barriers, clearer rules, and support from both governments, India is now more accessible than ever. Whether in whisky, EVs, biotech, or fintech, those who act early can gain a lasting foothold in one of the world’s most dynamic economies.

As Prime Minister Modi put it, the deal will “catalyse trade, investment, growth, job creation and innovation in both our economies.” It’s now up to UK businesses to seize that opportunity.

~ Written by Kartik Khati

Leave a Reply